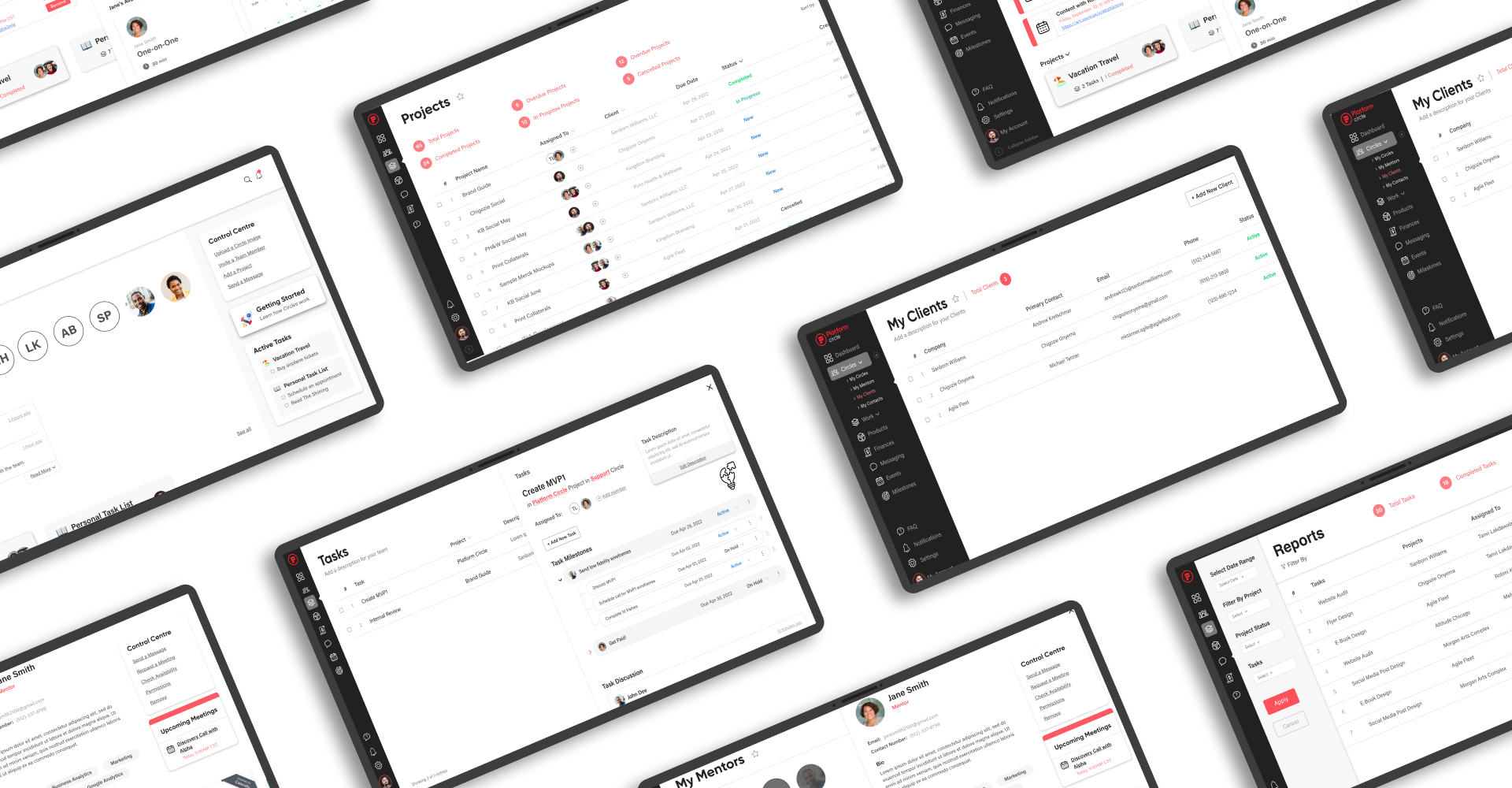

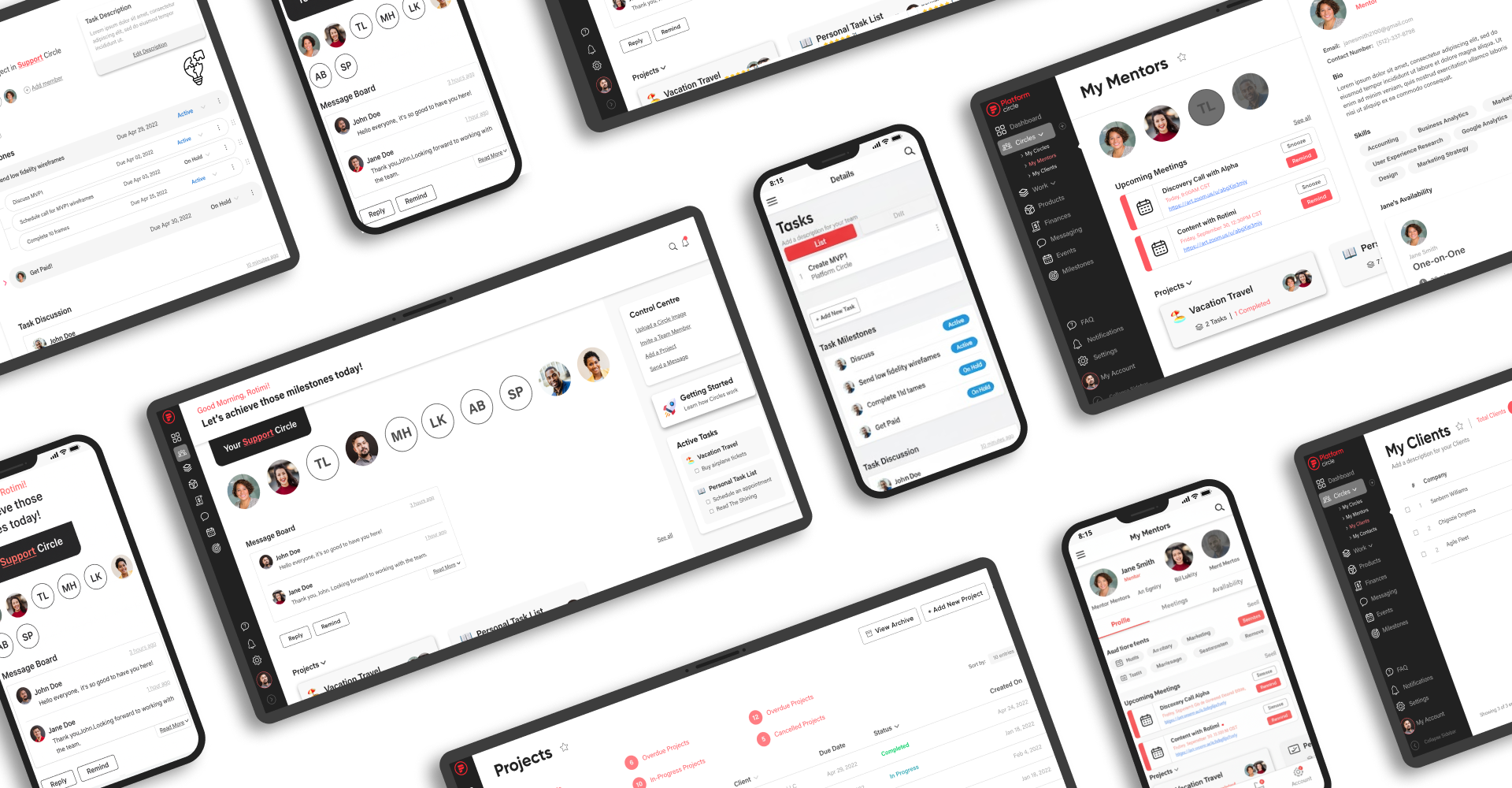

Platform Circle is a complete task management and team collaboration tool that aims to provide structure, clarity, and organization to day-to-day tasks. While the overwhelming complexity of traditional task management solutions is revealed by their overly complicated dashboards and user interface.

Platform Circle puts user experience, speed, and intuitive navigation at the forefront of the design process where all of the action in their flexible workflow tools gets done for you with minimal effort. Built on a ReactJS and NextJS front-end, with a fully scalable and performance-tuned NodeJS + MongoDB back-end, providing applications for teams of all sizes and prominence, it is a modern, responsive task management solution.

Flexibility in task presentation was one of the primary objectives when designing Platform Circle. Teams can customize the way they manage the work, using the view they prefer – ranging from a comprehensive List View to Kanban View that enables drag-and-drop processes; Calendar View to plan for deadlines, or Timeline View that makes tracking longer term projects simple and easy – while making sure that teams can understand their priorities at a glance and meet all deadlines without any confusion.